Glossary

absolute advantage

In a two-goods (grapes and nuts) two-persons (Tom and Mary) economy, Tom would have absolute advantage in producing nuts if he could produce more nuts in a day than Mary. In graphical terms, Tom's PPC (PPF) would have a higher intercept on the nuts axis in the grapes-nuts space. See also "comparative advantage."

adverse selection

The tendency of people with higher risk wanting to be insured and people with lower risk wanting to opt out.

- Crystal Ball

- Health Risk is a Matter of Life and Death

- Insurance at Risk

- The Market Role of Information

antitrust laws

Laws intended to protect consumer interests and preserve market competition.

arbitrage

The purchase of goods at a market where prices are lower to sell at a market where the prices are higher. These markets could be separated by geography or time. More generally, it is an attempt to gain profit by exploiting differences in prices, and other market-related conditions for similar products or situations.

- Airlines in Asia Offer Personalized Prices by Age, Race, Gender

- Border Patrol

- Global Labor Market

- One-Price Law – Making an Illegal Buck

- Opportunities Pay

- Price Signals as Guides for Resource Allocation

- Too Global To Be National?

- Trade Surplus Trap

asymmetric information

Information that is not equally shared between parties in a transaction. For example, the seller of a used car is likely to know more about the quality of the car than an average potential buyer.

- Insurance at Risk

- Joint Liability as Loan Collateral

- Market Intervention and Regulation

- The Market Role of Information

automatic stabilizer

An economic program that automatically expands during recessions or contracts during booms without additional legislation.

bond

A fixed-income (coupon) debt security issued by corporate or government borrowers. At issue, the coupon interest rate varies directly with the duration (maturity) of the bond and inversely with credit-worthiness of the issuers and is tied to the face value of the bond. The market price of the bond after initial issue may change depending on supply and demand while the coupon stays the same. So the yield (coupon/market price) varies in opposite direction with the market price.

- A Nation of Money Hoarders

- Banks and Non-Bank Finance

- Bond Free?

- Bonds vs Stocks

- Can Social Security Be Saved?

- Free Money?

- Liquidity Trap

- Ponzi Schemes

- Savers, Suckers?

- Shaky Union

- Sinking Dollar

- The Greek Debt Tragedy

- The Yield Curve

- Trade Surplus Trap

- Under Water

- Who Rates the Raters?

bracket creep

Income earners are moved to a higher income tax bracket based on their nominal incomes rather than their real incomes. The problem arises when incomes are adjusted upwards to offset price inflation but tax rates are tied to nominal incomes.

budget deficit

An excess of expenditures over revenues.

- Bond Free?

- Crowding-out Effect

- Deficit and Debt

- Eat Your Cake Now

- Flows and Stocks

- Free Money?

- Hedging Inflation with Prostitution

- Liquidity Trap

- The Greek Debt Tragedy

budget surplus

An excess of revenues over expenditures.

bundling

Offering a number of different goods in a package for one single price to maximize profit where the desired components in the package might vary among customers.

capital depreciation allowances

Non-cash accounting expenses put aside to cover depreciation of existing capital over its useful life. It offsets reported earnings and provides a cash flow for business operations.

capital flow

The movement of money across countries to buy foreign financial assets as well as to make direct investment in foreign plants and equipment. Money that is moved for short-term speculation is characterized as "hot" money because they can be quickly withdrawn. The movement of hot money often leads to financial asset bubbles in the destination economies and volatile fluctuations in the exchange rate of the destination currencies.

cartel

Combination of sellers (usually in a generic oligopoly) to control output, price, etc. at the expense of buyers. Cartels that are not sponsored by sovereign states are subject to prosecution under U.S. antitrust laws. OPEC (Organization of Petroleum Exporting Countries) is a prime example of international cartel sponsored by sovereign countries beyond the reach of U.S. antitrust laws.

circular flow

A model of how different parts of the economy are connected through the flows of physical goods and services mediated by counter-flows of money payments.

closed economy

An economy that is closed to trade with other countries.

Coase theorem

Negative or positive spillovers will occur at the optimal level (where marginal social benefit exactly offsets marginal social cost) regardless of the initial assignment of property rights if the cost of negotiating a settlement of spillover effects (i.e., transaction cost) is zero.

collusion

Attempts or agreements among cartel members to restrict output and raise prices.

commodities

Goods that are so homogeneous that sellers have little or no pricing power.

- Cleaning Up the Detergent Market

- Drinking Experience

- Flexible Pricing

- Just-in-time Labor Division

- Noodle Price-hike Conspiracy

- Price Searchers, Price Discriminators, and Price Takers

- Pricing and economic surplus

- The Rise of Chicken

- There Are no Widgets - Types of Goods

- Value-based Pricing

- Vitamin Inc.

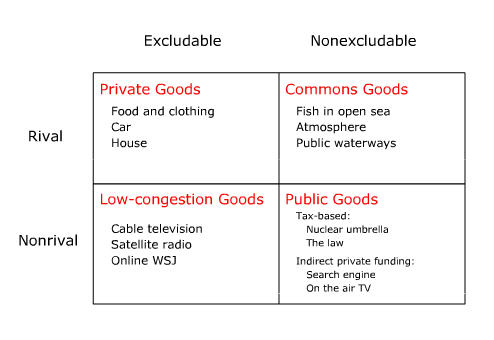

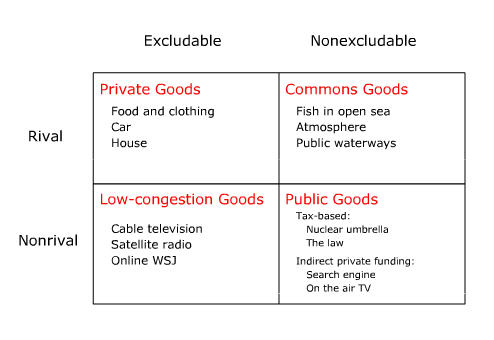

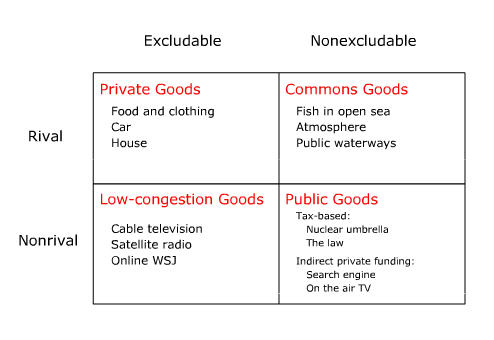

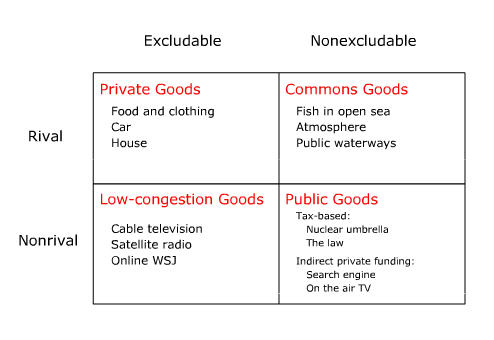

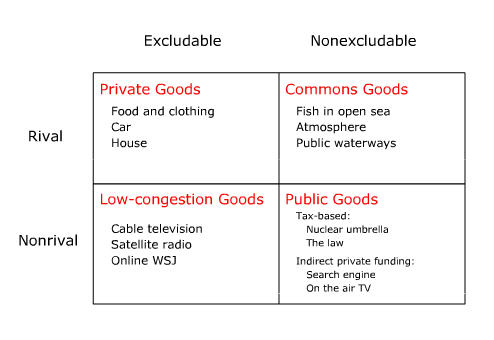

commons good

A commons good is one that is available to all potential users but subject to congestion. A popular public beach is a commons good prone to traffic congestion in summer.

- Free-Market Solutions

- Market Intervention and Regulation

- Property Rights and Externality

- Raiders of the Net

- Rivalry and Excludability in Goods

- Shovelers Keepers?

comparative advantage

In general, a worker or a country enjoys comparative advantage in producing a good or service if it can produce the good or service at a lower relative opportunity cost than another worker or country. In a two-goods (grapes and nuts) two-persons (Tom and Mary) economy, Tom would have comparative advantage in producing nuts if his opportunity cost of producing nuts in terms of grapes foregone is lower than Mary. In graphical terms, Tom's PPC (PPF) would have a flatter slope viewed from the nuts axis in the grapes-nuts space. But the intercept of Tom's PPC on the nuts axis need not be higher than that of Mary's PPC on the same axis.

- Efficient but not Fair?

- Gaining from Comparative Advantage

- No Chicken Feet!

- Transaction Costs and Market Structure

- Who Has Comparative Advantage?

compensating differential

Wage premium that is paid to compensate for above-average hardship in working conditions.

compensation board

Compensation board is a subset of the board of directors. Members are supposedly non-executive (not employees of the company) board members who decide on the compensation for the top executives. Since board members are paid very well by the company, they may not want to offend the top executives who more or less appoint them. Additionally, the top executive of one company may serve on the compensation committee of another company and vice versa.

complementary goods

Two goods (A and B) are complementary when an increase in quantity demanded for A due to a price decrease of A leads to an increase in demand for B and vice versa. For example, when airfare to Hawaii goes down, more tickets are sold. That is, quantity demanded increases. When more tickets are sold, more hotel rooms at Hawaii are needed even though hotel rates have not changed. That is, demand has increased. (Note: Professor Richard Evans provided this example.)

- Bundle of Sorrows

- Complements and Substitutes

- Small is beautiful?

- Streaming Revenues

- There Are no Widgets - Types of Goods

congestion game

A strategic game situation where the average payoff decreases as more people choose a given option.

- Congestion Pricing

- Coordination Game and Congestion Game

- Games people play (transcript)

- One Road's Congestion Is Another Road's Revenue

consumer price index

The Consumer Price Index (CPI) is a monthly measurement of retail price changes. It reports on the price changes of 80,000 items that represent a cross-section of goods and services purchased by urban households. The index is supposed to measure how price changes affect the purchasing power of income. When the index rises, the dollar buys less of the representative basket of goods and services included in the index.

consumer surplus

Consumer surplus is the gap between what buyers are willing to pay and what they actually pay. Consumer surplus is highest when sellers' economic profit is zero and is zero when sellers can practice perfect price discrimination (i.e., selling each unit at buyer's reservation price). See also "economic surplus."

- A la carte or Set Menu?

- Cheap Pearls

- Competitive Strategy

- How Much Is Anything Worth?

- Just-in-time Labor Division

- Premium from Freemium

- Pricing and economic surplus

- Should parking be free?

- Why Are Better Seats "Underpriced"?

consumption rivalry

The inability of a good to serve simultaneously more than one user without quality degradation. For example, there is consumption rivalry for an apple between more than one user. But there is no consumption rivalry for public radio signals among listeners. See also "private goods," "public goods," "low-congestion goods," and "commons goods."

- He Who Pays the Piper

- Premium from Freemium

- Rivalry and Excludability in Goods

- There Are no Widgets - Types of Goods

coordination game

A strategic game situation where the average payoff increases as more people choose a given option.

- Coordination Game and Congestion Game

- Games people play (transcript)

- Right Priority

- Systems Competition and Network Effects

cost glossary

A glossary of terms in short-run production and cost.

credit

A credit is created with a loan from a commercial bank or the capital market in general. A loan from a commercial bank in a fractional-reserve banking system results in money creation, while a loan from the non-bank capital market simply creates an interest-bearing contract for a temporary use of existing money.

- Banks and Non-Bank Finance

- Bubble Economics

- Bubble Saving

- Dividing the Pie

- Free Money?

- Who Rates the Raters?

credit default swap

A credit default swap (CDS) is a swap contract in which the protection buyer of the CDS makes a series of payments to the protection seller and, in exchange, receives a payoff if a credit instrument (typically a bond or loan) goes into default. It is essentially an unregulated insurance contract without any reserve requirement on the party of the seller or insurable interest on the party of the buyer. CDS gave unwarranted assurance of credit-worthiness to subprime asset-backed debt securities and contributed to the asset bubble and subsequent credit crunch of 2007.

- Banks and Non-Bank Finance

- Bubble Economics

- The Greek Debt Tragedy

- Too Big to Fail

- Under Water

- Who Needs Casinos?

critical mass

The minimum size of subscribers needed to generate explosive growth of an activity.

- Critical-mass Game and Gender Preference Game

- Dying for Money?

- Genericization as a Market Maker

- Insurance at Risk

- Niche Competition

- Private Truths and Public Lies

cross price elasticity of demand

Percentage change in quantity demanded of good B over percentage change in the price of good A. If the resulting ratio has a positive numerical value, A and B are complements. If the resulting ratio has a negative value, A and B are substitutes.

crowding out

Reduction in private consumption or investment as a result of increase in government spending.

de facto rights

De facto rights exist by custom or by default and cannot be easily taken away. But because of their uncertain legal status, they cannot be transferred or monetized. Therefore their money value is much less than their use value. The time customers can spend in a restaurant for their meals and the amount of soy sauce customers can use in a Chinese restaurant are examples of de facto rights.

deadweight loss

The loss of economic surplus due to an inefficient level of economic activities where economic surplus is defined as the difference between the reservation price (highest price one is willing to pay) and the marginal cost of a good.

demand schedule (curve)

A set of price-quantity points that depicts how quantity demanded of a good is affected by changing prices. In graphical terms, a demand schedule is generally a downward-sloping curve with price on the vertical axis and quantity demanded on the horizontal axis. The downward-sloping curve shows the inverse relationship between price and quantity demanded. On a given demand curve, factors other than own price that might also affect quantity demanded are assumed to be unchanged.

demand vs quantity demanded

Demand generally refers to the whole demand curve while quantity demanded refers to a point on the demand curve. A movement along a demand curve in response to a change in own price is called a change in quantity demanded, while a change in demand involves a physical shift of the demand curve in response to changes in factors other than own price.

derivative

A financial contract used to hedge risk or to speculate on the value of an underlying asset, typically stocks, bonds, commodities, currencies, interest rates and market indexes. Examples of derivatives include futures, options, and swaps. Most derivatives are highly leveraged and can lead to huge losses or gains.

differentiated products

Mature products that are modified to gain a slight edge over similar products to escape the fate of being a commodity.

diminishing marginal utility

When total utility increases at a decreasing rate as more of the same activity is pursued over a concentrated period of time, marginal utility is said to be diminishing.

diminishing returns

See "law of diminishing returns."

disposable income

Take-home pay (after taxes) that is available for spending and saving to individual earners.

- Bubble Saving

- Is Japan Saving Too Much?

- Jobless Safety Net

- Taxes and Commercials, Necessary Evils?

- When a Vice Becomes a Virtue - Is The U.S. Saving Too Little?

disruptive technology

Game-changing technology that overthrows the dominant technology by first invading the low-end market that is ignored by the dominant technology.

dominant strategy

A strategy that has better payoffs regardless of what strategy the other players might choose. For example, in a PD game, choosing L is the dominant strategy as the L payoff curve is everywhere above the R payoff curve. But pursuing the dominant strategy does not guarantee a collectively superior solution.

economic profit

Total returns minus total opportunity cost. In other words, when economic profit is zero, all the opportunity costs are covered.

economic rent

Economic rent is a payment made to a resource in excess of what is required to elicit its supply. The payment arises from current supply scarcity or legacy benefits that are difficult to do away with. It is needed to determine the employment but not the availability of that resource.

economic surplus

Marginal economic surplus is the difference between the reservation price (highest price one is willing to pay) and the marginal cost of a good. Total economic surplus is the sum of total consumer surplus and total economic profit. Total economic surplus is also the difference between TWP and TC. Under perfect price discrimination, economic surplus is maximized when profit is maximized. But under single pricing, maximizing profit does not generally maximize economic surplus.

effective care

Effective care interventions are viewed as medically necessary care on the basis of clinical outcome evidence (Wennberg).

efficiency

A state when the marginal social benefit of an activity is equal to its marginal social cost.

elastic demand

Demand is elastic when the percentage change in quantity demanded is larger than the percentage change in price. Total revenue would increase with price decreases and decrease with price increases.

- Demand Elasticity and Total Revenue

- Discriminating Business Sense

- Lounging in Luxury - Can You Afford It?

- Why Are the Prices Different?

encompassing interest

If an individual, or an organization is entitled to a substantial portion of any increase in the output of a society and bears a large proportion of any drop in this social output, that individual or organization has an encompassing interest in that society.

equilibrium

A state on which the system will settle after all the necessary adjustments are made and will persist if exogenous factors stay unchanged. A market is said to be in equilibrium when the quantity supplied is equal to the quantity demanded at the market-clearing price.

excess demand

The excess of quantity demanded over quantity supplied at a given price. Also known as shortage.

- Excess Demand Blues - Scalpers profit from ticket shortage

- Price Signals as Guides for Resource Allocation

excess supply

The excess of quantity supplied over quantity demanded at a given price. Also known as surplus.

exchange value

Value derived from selling a good for money as contrasted to using the good for self consumption. For example, full-fledged property rights have exchange value because they can be sold. On the other hand, de facto rights cannot be sold and have only use value to the current owners.

excludability

The ability to exclude non-paying users.

expected value

The expected value of a gamble is the average value of the payoffs weighted by their probabilities.

external benefits

Free benefits conferred on innocent third parties due to unassigned or poorly assigned property rights or when the cost exceeds the benefit of exercising properly assigned rights. Also known as positive externality.

- Busy Bees cartoon

- Condom Economics

- External Benefit and External Cost

- Free-Market Solutions

- Property Rights and Externality

- Spillovers Are Not Always Externalities

- Systems Competition and Network Effects

- The Tyranny of Small Decisions

- Your Customers Are My Customers

external costs

Uncompensated cost imposed on innocent third parties due to unassigned or poorly assigned property rights or when the cost exceeds the benefit of exercising properly assigned rights. Also known as negative externality.

- External Benefit and External Cost

- Prices and Sanctions?

- Property Rights and Externality

- Scoop Your Poop

- Spillovers Are Not Always Externalities

- The Tyranny of Small Decisions

externality

Free benefits conferred or uncompensated cost imposed on innocent third parties due to unassigned or poorly assigned property rights or when the cost exceeds the benefit of exercising properly assigned rights.

- A Good Fence Makes Good Neighbors

- Condom Economics

- Congestion Pricing

- Fished Out!

- Green Tax

- Happiness - Absolute or Relative?

- One Road's Congestion Is Another Road's Revenue

- Property Rights and Externality

- Spent Guns

- Spillovers Are Not Always Externalities

- Systems Competition and Network Effects

- There Are no Widgets - Types of Goods

fixed cost

Cost that stays the same in the short run regardless of the level of output or action taken. Graphically, fixed cost is represented by a horizontal line from the cost axis in the cost-output space.

flat-rate pricing

Offering unlimited access to goods or services at one single price.

flow

A flow is measured over a period of time. It is like an ongoing movie. A stock is measured at one point of time. It is like a snapshot photo that freezes the actions of a flow.

free rider

A non-paying user of non-excludable goods, which may or may not be subject to consumption rivalry. Non-excludability may be due to a choice not to exclude even though it may be technically feasible to exclude.

- Free Riding on Preventive Health Care

- He Who Pays the Piper

- Rivalry and Excludability in Goods

- The Logic of Collective Action

game theory

Analysis of optimal decision in competitive situations.

- Coordination Game and Congestion Game

- Critical-mass Game and Gender Preference Game

- Fat Nation

- Games Are Serious and Ubiquitous

- Invisible-hand Game and Prisoner's Dilemma Game

- Lending an Invisible Hand

- On Your Mark. Get Set. Scrub!

- Trust and Betrayal

gold standard

a monetary standard under which the basic unit of currency was tied to a stated quantity of gold, other money could be freely converted into gold, and trade balances were settled by free export and import of gold among countries. Under this fixed exchange system, countries with trade deficits must reduce their money supply (to induce domestic price deflation) and countries with trade surpluses must increase their money supply (to induce domestic price inflation) to restore trade balances. Such monetary disciplines proved to be so onerous that the gold standard was finally abandoned for good in 1971.

Gross domestic product (GDP)

Gross domestic product (GDP) measures the total market value of all final goods and services produced in a country in a given year, plus exports, minus imports. "Gross" means that capital depreciation allowances have not been netted out from the total.

- Bubble Economics

- Deficit and Debt (transcript)

- Dividing the Pie

- Flows and Stocks

- Free Money?

- Income Lotteries

- Is Japan Saving Too Much?

- Less than Meets the Eye

- Liquidity Trap

- Ponzi Schemes

- Price Sentinel – CPI

- Re-counting GDP

- Shaky Union

- The Case for Sweatshops

- The Greek Debt Tragedy

- To Revalue or Not to Revalue – The Yuan Story

- Too Big to Fail

- Too Global To Be National?

- Trade Deficits (transcript)

- Trade Surplus Trap

- Value vs. Weight

gross profit margin

Gross profit margin is gross profit (gross of administrative and selling expenses) divided by net sales.

incidence (tax)

A measure of who ultimately bears the burden of tax.

income

Income includes wages, government transfer payments such as Social Security, dividend income from stocks. Gains on assets, such as stocks, or the increase in equity in a house are not considered as saving. Both income and saving are flows of currently produced goods and services.

increasing returns

See "scale economies."

inelastic demand

Demand is inelastic when the percentage change in quantity demanded is smaller than the percentage change in price. Total revenue would increase with price increases and decrease with price decreases.

- Drinking Experience

- Lounging in Luxury - Can You Afford It?

- Underground Sins

- Why Are the Prices Different?

inferior good

Goods that are purchased less with higher income, such as generic products or house brands.

inflation breakeven rate

Inflation breakeven rate refers to the difference between the nominal yield on 10-year Treasury notes and the real yield on 10-year Treasury inflation-protected securities (TIPS).

inflection point

A transition point between the increasing-slope segment and the decreasing-slope segment of an S-shaped curve.

information asymmetry

Unequal sharing of information between parties in a transaction. For example, the seller of a used car is likely to know more about the quality of the car than an average potential buyer.

injection

A source of expenditure or funds. For example, a government stimulus in a recession is an extra source of expenditure. The purchase of long-term Treasury bonds by the Fed is an example of money injection into the credit market.

intercept

The point at which a curve intersects the vertical or horizontal axis of a two dimensional diagram.

investment grade

The minimum risk rating that a bond must receive in order to be acceptable as investment by banks and other financial institutions because the default risk is considered to be low enough.

investment grade spread

The gap between yields between investment-grade corporate bonds and Treasury bonds of the same maturity. The size of the spread reflects market perception of the default risk of corporate bonds. Corporate bonds must offer higher yield during economic recession to attract risk-averse investors.

invisible hand

The self-organizing tendency of un-coordinated and self-regarding efforts to achieve a collective good.

- Aborting White Flight

- Fat Nation

- Invisible-hand Game and Prisoner's Dilemma Game

- Lending an Invisible Hand

law of demand

The inverse relationship between the price and the quantity demanded of a good when all other factors are assumed to be constant.

law of diminishing returns

The law says that when some factors of production (inputs) are fixed in capacity in the short run, increasing the variable input working with the fixed inputs would first lead to increasing additional output per additional unit of variable input, but eventually decreasing additional output per additional unit of variable input.

leakage

A diversion of income or funds from the circular flow of income. Saving and imports are considered to be leakages.

leverage

The amount of debt used to finance an investment. For example, an investment valued at $10,000 but with only $1,000 equity capital is said to have a leverage ratio of 10:1 (i.e., 10,000/1000 = 10). In other words, $9,000 is financed by debt.

liquidity trap

A situation whereby the interest rates could not go any lower no matter how much the central bank tries to increase money supply and that even the very low interest rates could not stimulate any more economic activities.

low-congestion goods

Goods that are not subject to consumption rivalry but can easily exclude non-payers.

luxury good

A luxury good offers a superior consumer experience for the few who can afford it.

margin

The percentage of investor capital required to maintain a debt incurred in an investment. The higher the margin required, the lower the loan the investor can borrow. In other words, leverage ratio = 1/margin. For example, a leverage ratio of 10:1 would lead to a margin of 1:10. That means you have to have $1 of your own money to borrow $9. A margin call is issued by the creditor when the net value (i.e., asset current price - loan value) of the loan falls below the margin requirement (i.e., asset current price*margin).

marginal benefit

Addition to total benefit arising from buying one more unit or taking one more step. It is represented by the reservation price (highest possible price) the buyer is willing to pay. It is equal to the marginal revenue received by the perfect price discriminator, but higher than the marginal revenue received by the single-price searcher and generally by the price taker except for the last unit sold.

- Load Pricing

- Metered Consumption

- Price Searchers, Price Discriminators, and Price Takers

- Unsinkable Sunk Cost

marginal cost

Addition to total cost arising from producing one more unit or taking one more step. In the short run with fixed cost, these additions consist of entirely variable costs. When total variable cost increases at an increasing rate, marginal cost will increase. Under diminishing returns, marginal cost will be higher than average cost if average cost is rising and marginal cost will be lower than average cost if average cost is falling.

- Load Pricing

- Marginal Cost and Average Total Cost

- Marginal Cost, Average Variable Cost and Average Fixed Cost

- Metered Consumption

- Pay What You Want

- Premium from Freemium

- Price Searchers, Price Discriminators, and Price Takers

- Unsinkable Sunk Cost

- Untangling Marginal vs Average Value

marginal propensity to consume

Additional consumption out of an increase in income expressed as a percentage. Aka MPC.

marginal propensity to save

Additional saving out of an increase in income expressed as a percentage. Aka MPS. It represents a leakage in the circular flow of income.

marginal revenue

Addition to total revenue arising from producing one more unit or taking one more step. Marginal revenue (MR) is equal to price (P) for price takers who must accept the single market price and perfect price discriminators who can sell each unit at its reservation price. MR is below P under single-price searchers who must lower the price for all units just to sell one more unit.

marital sorting

The tendency of marrying within one's income, education, ethnic, and religious group.

market signaling

Proxy information that is sent between buyers and sellers to convey the quality of the product that is difficult to detect by visual inspection. To be convincing, the signal must be difficult to fake.

market structure

Market structure depends on the uniqueness of the products, barrier to entry, and scale economy. Specifically, the more unique the product, the higher the entry barrier, and the larger the scale economy is, the greater the pricing power.

market-clearing price

The price at which the supply and demand curves intersect and the quantity supplied is just equal to the quantity demanded.

mixed bundling

Offering a number of different goods in a package for one single price as well as selling the goods separately at higher prices.

monopolistic competition

An industry with many small competitors each with some price-setting power selling slightly differentiated products. Also known as price searchers.

monopoly

An industry with a single seller selling a unique (or patented) product and has enough market power to practice effective price discrimination.

- Aerial Predators?

- Battles of Standards

- From Brands to Generics - No Monopoly, No Competition

- Market structure taxonomy

moral hazard

A tendency to be more willing to take a risk, knowing that the potential costs or burdens of taking such risk will be borne, in whole or in part, by others (Wikipedia). For example, the tendency for the insured to take less care to prevent loss.

MPC

Marginal propensity to consume. Additional consumption out of an increase in income expressed as a percentage.

MPS

Marginal propensity to save. Additional saving out of an increase in income expressed as a percentage. It represents a leakage in the circular flow of income.

multiplier

1/leakage rate. For example, the expenditure multiplier = 1/MPS where MPS is the marginal propensity to save. The money multiplier = 1/ RR where RR is the reserve ratio.

Nash equilibrium

A stable solution in a game situation where no parties want to change strategy given the choice of other parties. A Nash equilibrium may not be collectively superior as in the case of the Prisoner's Dilemma game.

natural monopoly

A monopoly that arises from persistently declining average total cost (ATC) over the whole span of the demand curve. As a result, marginal cost (MC) is always below the monopolist's ATC.

negative feedback

A response in the opposite direction to the initial perturbation in a loop system. A successful negative feedback process will stabilize the system to a steady state.

net export

Exports - imports. Net export can be positive resulting in a trade surplus, or negative resulting in a trade deficit.

network externality

The interdependence of demand among users of some goods whose usefulness varies with how many others are also using the goods in question. For example, fax machines and telephones.

nominal interest rate

It is the face-value interest rate before discounting for price inflation.

nominal vs real

A nominal value is expressed in historical money terms. By contrast, a real value has been adjusted from a nominal value to remove the effects of general price level changes from the base reference year.

normal good

Goods that are purchased more with higher income and less with lower income.

obsolescence

Economic obsolescence refers to the loss of economic value in a good that is still physically viable. For example, a car that has an mpg of 5 may still be physically operable but is no longer economically viable when gasoline sells for $5 a gallon. Economic obsolescence may be "planned" by the manufacturer of the good to hasten the replacement purchase cycle of consumers. This can be accomplished by "newly improving" it.

offshoring

The outsourcing of jobs to overseas where labor cost is much lower.

oligopoly

An industry dominated by a few large firms. A generic oligopoly sells homogeneous products. A differentiated oligopoly sells differentiated products.

- Cleaning Up the Detergent Market

- Competitive Strategy

- Market structure taxonomy

- Too Much Vitamin C?

- Vitamin Inc.

open economy

An economy that is open to trade with other countries.

opportunity cost

The cost of a resource or an action as measured by the value of the current best alternative opportunity, rather than by its committed (i.e., historical) value. As such, opportunity cost could be higher or lower than the committed (historical) cost depending on the abundance or lack of alternative uses for a given resource.

- A Matter of Opportunities

- Baby Dilemma

- Happy Hogging!

- My Prom Dates

- Opportunities Pay

- Picket Line for Rent

- The Seduction of Cheap Labor

- The Wedding Party Dilemma- To Go or Not to Go?

- Why Do Immigrants Own Inner-City Stores?

- Windfall Profit

paradox of thrift

An attempt for a closed economy to save more may lead to a reduction in saving if the plan to save more is not matched by the plan to invest more.

patent

A temporary but exclusive right given by the government to an inventor to profit from the invention in exchange for sharing the information with the public.

- Competitive Strategy

- From Brands to Generics - No Monopoly, No Competition

- Patently Deadly

- Power Play

- The Patent Fence

pattern bargaining

A collective bargaining arrangement used by labor unions in oligopolistic industries in which contract terms in one settlement are applied to other firms within the same industry.

payoffs matrix

In a two-party two-strategy game, the payoffs matrix is a 2 by 2 table with 4 cells each of which containing the cardinal payoffs to each party for adopting one of the 4 possible combinations of strategies. For example, the payoffs matrix for a Prisoner's Dilemma game for John and Mary with the L and R strategies may look like the following:

perfect competition

A market structure where barriers to entry and exit are absent. Sellers have no individual pricing power but must sell at the prevailing market price. At equilibrium, sellers just cover all costs and earn zero economic profit.

- A Fable of Fruit Vendors

- Competitive Strategy

- Market structure taxonomy

- Noodle Price-hike Conspiracy

- Pricing and economic surplus

perfect price discriminators

Sellers facing a downward-sloping curve whose products are unique enough to allow the sellers to charge the highest possible price that each unit can command. Total revenue (TWP) rises until price goes down to zero. On the other hand, total revenue of single-pricing sellers assumes an inverted U shape.

- How Much Is Anything Worth?

- Marginal Revenue of Perfect Price Discriminators

- Price Searchers, Price Discriminators, and Price Takers

planned vs realized

In the real world, what is realized may not be what is planned. For example, a married couple does not imply a happily married couple. But the marriage will last only if the couple is happily married. In terms of income determination, a given level of income can be sustained only if planned investment is equal to planned saving because what is not spent on consumption must be plowed back into investment to stop the leakage from the income stream. But in terms of income accounting, realized saving must always be equal to realized investment. For example, capital goods that are not sold end up as unplanned inventory of the producer.

- Circular Flow (transcript)

- Crowding-out Effect (transcript)

- Injections and Leakages - Planned vs Realized

positive feedback

A response in the same direction as the initial perturbation in a loop system. An unchecked positive feedback process would lead to an eventual systemic collapse.

preference-sensitive care

Preference-sensitive care comprises treatments that involve significant tradeoffs affecting the patient's quality and/or length of life, such as breast cancer surgery. (Wennberg).

present-bias effect

The tendency to give more weight to the more immediate moment as it draws closer. Such a bias, however, may lead to different behaviors depending on whether the choices involve immediate costs or immediate rewards. When costs are immediate and rewards are delayed, there is a tendency to procrastinate. When rewards are immediate and costs are delayed, there is a tendency to appropriate the rewards.

presumed rights

Presumed rights exist because of sympathy and solidarity with victims of sudden misfortune. Such rights tend to dissipate over time unless enshrined into misguided laws.

price ceiling

When prices are set artificially below the market-clearing level, the controlled price is a ceiling above which it is not allowed to rise. A price ceiling would result in excess demand or shortage.

- Management Tournament?

- One-Price Law – Making an Illegal Buck

- Price Signals as Guides for Resource Allocation

- Rent Ceiling

price competition

Competing for business on the basis of lower prices.

price control

Setting the price below the market-clearing level.

- Censoring Pleas for Help

- Hedging Inflation with Prostitution

- One-Price Law – Making an Illegal Buck

- Price Signals as Guides for Resource Allocation

price discrimination

Charging different customers at or close to their reservation prices for the same goods. Price discrimination is intended to increase sellers' economic profit and reduce consumer surplus.

- A Fable of Fruit Vendors

- Airlines in Asia Offer Personalized Prices by Age, Race, Gender

- Banks and Others Base Their Service On Their Most Profitable Customers

- Competitive Strategy

- Discriminating Business Sense

- Fare Game

- Get in Where You Fit in

- Market structure taxonomy

- Pay What You Want

- Pricing and economic surplus

- Virtual Scalping

- Why Are Plane Tickets Nontransferable?

- Why Are the Prices Different?

price fixing

Collusion among sellers to set prices which are likely to be higher than those under unrestricted price competition. It is most common and more likely to be successful in product markets with a few dominant major players. Usually, output is restricted to support the higher fixed price. Price fixing is illegal in most countries, but domestic antitrust laws are powerless against price-fixing collusion among sovereign countries, such as OPEC.

price floor

When prices are set artificially above the market-clearing level, the supported price is a floor below which it is not allowed to fall. A price floor would result in excess supply or surplus.

price searchers

Sellers facing a downward-sloping curve who must search for the profit-maximizing price.

price support

Setting the price above the market-clearing level.

price takers

Sellers facing a horizontal demand curve who must sell all their goods at the market-determined prices.

principal-agent problem

The divergence of interests between the principal and its agents. Also known as the agency problem.

prisoner's dilemma

A game situation where self interest conflicts with group interest.

- Aborting White Flight

- Cleaning Up the Detergent Market

- Games Are Serious and Ubiquitous

- Invisible-hand Game and Prisoner's Dilemma Game

- Prisoner's Dilemma

- Rebate Coupons

- Tipping the Scales

- Who Sets the Curve?

private goods

Goods that are subject to consumption rivalry but can easily exclude non-payers.

- Premium from Freemium

- Private Goods vs Public Goods

- Rivalry and Excludability in Goods

- Shovelers Keepers?

- There Are no Widgets - Types of Goods

private goods (demand for)

The demand curve for private goods is a horizontal summation of individual demands because consumption of private goods is subject to rivalry.

product competition

Competing for business on the basis of innovative products.

production possibilities curve (frontier)

A convex (bowed out from the origin) curve that shows all the possible maximum (i.e., efficient) combinations of goods that could be produced with the available resources given existing technology. The convexity of the curve shows increasing opportunity cost of producing good X in terms of foregone Y as more X is produced, and vice versa.

profit maximization

In the short run with fixed costs, a firm maximizes economic profit by equating marginal revenue (MR) with marginal variable cost (MC) when MC is increasing. Marginal revenue is lower than price (i.e., MR < P) if the firm must lower the price for all units just to sell one more unit.

- Fund Raising at the Margin

- Profit Maximization Under Natural Monopoly

- Profit Maximization of Price Takers

- Profit maximization under single pricing

- Profit vs Efficiency Maximization

property right

The control over the use or transfer of a resource. Property right is conducive to efficient use of scarce resources as owners have an incentive to maximize their long-term returns.

- A Good Fence Makes Good Neighbors

- Dying for Money?

- Enforce It or Lose It

- Fished Out!

- Free-Market Solutions

- Making Animal Conservation Pay

- Market Entry

- Market Intervention and Regulation

- Owners, Keepers?

- Patently Deadly

- Pricing and economic surplus

- Property Rights and Externality

- Right Makes Might

- Rivalry and Excludability in Goods

- Shovelers Keepers?

- Spillovers Are Not Always Externalities

- Squatters' Rights

- The Dust Bowl - Natural or Man-made Disaster?

- The Soviet Union - Super Power or Paper Tiger?

- The Tragedy of the Anticommons

- Water Disputes in California

- What Makes Rights?

- Windfall Profit

- Yellow Cabs, Red Tape

public goods

Goods that are not subject to consumption rivalry but cannot easily exclude non-payers either by design or due to technical difficulty.

- He Who Pays the Piper

- Market Intervention and Regulation

- Premium from Freemium

- Private Goods vs Public Goods

- Rivalry and Excludability in Goods

- There Are no Widgets - Types of Goods

public goods (demand for)

The demand curve for public goods represents a vertical summation of individual demands because consumption of public goods is not subject to rivalry.

purchasing power parity

A hypothetical exchange rate whereby an identical good in two different countries has the same price when expressed in either currency.

quantitative easing

A way for the central bank to increase the money supply by buying lower-quality securities from the market when very low short-term interest rates are no longer sufficient to revive the weak economy.

real exchange rate

The real exchange rate tells you how much a domestic item is worth compared to a similar foreign item. Using the domestic item as the basis for comparison, if the real exchange rate is less than 1, the domestic item is less expensive. If the exchange rate is more than 1, the domestic item is more expensive.

real interest rate

It is the difference between the nominal interest rate and the inflation rate. The real interest rate could be negative if the inflation rate is higher than the nominal interest rate.

real vs nominal

A nominal value is expressed in historical money terms. By contrast, a real value has been adjusted from a nominal value to remove the effects of general price level changes from the base reference year.

regulation

Government actions to temper the adverse effects of uncontrolled market activities.

- Bottom Fishing

- Bundle of Sorrows

- Byrding for Profit

- Flying in the Red

- Free-Market Solutions

- Guilt-free Pollution

- Licensed to Kill?

- Making Animal Conservation Pay

- Market Intervention and Regulation

- Milked to Order

- Prices and Sanctions?

- Strange Bedfellows!

- The Flipper Factor

- The Orphan Chase

- Too Much Vitamin C?

- Transaction Costs and Market Structure

- Windfall Profit

rent dissipation

Economic rent is dissipated when it is neither available to rent seekers nor those who create the rent by restricting economic activities desired by rent seekers.

rent seeking

Using valuable resources to secure the rights to economic rents that arise from artificial restriction of economic activities desired by rent seekers.

reservation price

The highest price a buyer is willing to pay rather than doing without.

- Crystal Ball

- Get in Where You Fit in

- How Much Is Anything Worth?

- Lounging in Luxury - Can You Afford It?

- Pay What You Want

- Price Searchers, Price Discriminators, and Price Takers

- Pricing and economic surplus

reserve currency

A foreign currency held by central banks and other major financial institutions to settle international debts, or to manage their exchange rates. Currently, the U.S. dollar is the primary reserve currency in which many major internationally traded commodities are quoted.

reserve ratio

The fraction of money reserve required to back up a bank loan expressed as a percentage. Aka RR.

revaluation

An upward adjustment of the foreign exchange value of a domestic currency (say Chinese yuan) vs a foreign currency (say US dollar). After the upward adjustment, one yuan will buy more US dollar making dollar-priced goods less expensive to the Chinese buyers and yuan-priced goods more expensive to American buyers.

right to work

Workers in Right to Work states cannot be required to join or pay dues to a union.

risk averse

The tendency to choose a sure gain over a gamble with equal expected value.

risk neutral

The tendency to be indifferent between a sure thing and a gamble with equal expected value.

risk seeking

The tendency to choose a gamble with an expected value equal to a sure loss.

RR

Reserve ratio. The fraction of money reserve required to back up a bank loan expressed as a percentage.

securitization

The process of repackaging financial assets with regular cash flows into smaller-denominated bonds with different risk-based yields for retail investors. Mortgages, credit-card loans and auto loans have been securitized. Securitization improves liquidity in the credit market by allowing smaller investors to invest in a larger pool of financial assets.

shareable good

Occasional-use, multiple-occupancy capital goods that could be shared within a peer-to-peer network set up by internet-mediated middlemen. Access to instead of ownership of these goods could save scarce resources and reduce environmental impact.

short run

A time horizon that is too short for the fixed input to be adjusted or for all costs to be variable.

shortage

The excess of quantity demanded over quantity supplied at a given price. Also known as excess demand.

- Excess Demand Blues - Scalpers profit from ticket shortage

- Happy Hogging!

- Licensed to Kill?

- Price Signals as Guides for Resource Allocation

- Rent Ceiling

- Yellow Cabs, Red Tape

shut-down point

The point on the short-run supply curve of a price taker that intersects the minimum average variable cost. The price taker will quit producing when price is below this level because there is no point to operate when even variable cost (which does not have to be incurred otherwise) cannot be covered.

single pricing

Charging the same price to all buyers regardless of their reservation prices in one pricing period. Those buyers whose reservation prices are higher than the single price will gain consumer surplus. All sellers who are not practicing perfect price discrimination are single pricers to various degrees. However, price takers individually have no power to change the single price. Only price searchers can adjust their single prices to take advantage of varying demand elasticities over prices.

spillover effects

Unintended positive or negative effects of an action. Spillover effects are not necessarily externalities if they have been internalized when property rights are clearly defined. Spillover effects become externalities if property rights have not been clearly defined or the enforcement cost exceeds the benefit of internalizing the externalities.

static efficiency

Efficiency resulting from doing things right rather than doing the right things. For example, a firm can try to maximize profit from selling a commodity with very low profit margin to gain static efficiency. But the firm might be better off coming up with innovative products with higher profit margin to gain dynamic efficiency.

statistical discrimination

Statistical discrimination is the practice of treating all members of a stereotyped group equally due to the high cost of customized treatment for each individual. As a result, individuals in the group having characteristics that are worse or better than the stereotypical average would benefit or suffer from the equal treatment.

sterilization

A central bank action to offset unintended changes in the domestic money base resulting from foreign exchange transactions. For example, the central bank may buy a foreign currency with domestic currency to prevent appreciation of its domestic currency and mop up the excess domestic currency by selling domestic bonds.

stock

A flow is measured over a period of time. It is like an ongoing movie. A stock is measured at one point of time. It is like a snapshot photo that freezes the actions of a flow.

stock options

Stock options confer to employees the right (not an obligation) to buy a certain number of shares in a company at a fixed price pegged to the trading price at the time of the grant (i.e., the grant price or strike price). Employees are willing to accept l

strategic behavior

Behavior in a game situation that takes into account the effect of one's action on other players subsequent moves.

substitutes

Two goods (A and B) are substitutes when an increase in quantity demanded for A due to a price decrease of A leads to a decrease in demand for B and vice versa.

- Complements and Substitutes

- From Seahorses to Viagra

- Global Labor Market

- How Much Is Anything Worth?

- Pricing and economic surplus

- Value-based Pricing

- Your Technology or Your Market Access

sunk cost

Cost that cannot be recovered or diverted towards alternative uses.

supply curve (price taker)

The short-run supply curve of a price taker is the upward-sloping segment of the MC curve above the minimum AVC point.

supply schedule (curve)

A set of price-quantity points that depicts how quantity supplied of a good is affected by changing prices. In graphical terms, a supply schedule is generally an upward-sloping curve with price on the vertical axis and quantity demanded on the horizontal axis. The upward-sloping curve shows the positive relationship between price and quantity demanded. On a given supply curve, factors other than own price that might also affect quantity supplied are assumed to be unchanged.

surplus

The excess of quantity supplied over quantity demanded at a given price. Also known as excess supply.

- Cheap Pearls

- Competitive Strategy

- Guy Glut

- How Much Is Anything Worth?

- Legacy Curse

- Milked to Order

- Price Signals as Guides for Resource Allocation

- Roemer's Law of Demand

- Sugar Daddy

- Why Are Better Seats "Underpriced"?

swap

Unregulated and no-reserve insurance.

threshold sequence

A threshold sequence is a list of individuals represented in an ascending order by the minimum number of visible fellow dissidents that would induce them to reveal their dissident identity.

total revenue (perfect price discriminator)

See "total willingness to pay".

total revenue (price searcher)

A single-pricing price searcher facing a linear downward-sloping demand curve has an inverted U-shaped total revenue curve as the price is lowered from the elastic demand range to the inelastic demand range.

total revenue (price taker)

The total revenue curve of a price taker is an upward-sloping straight line from the origin of the quantity-revenue space since the seller can sell as much as he wants at the same market-determined price.

total willingness to pay (TWP)

The total revenue curve of a perfect price discriminator when it can charge each unit the highest possible price the consumer is willing to pay (i.e., reservation price).

trade deficit

An excess of imports over exports.

- Bubble Saving

- Free Money?

- Is China on a 'Gold Standard'?

- To Revalue or Not to Revalue – The Yuan Story

- Trade Deficits

tragedy of the commons

Tragedy of the commons occurs when over-exploitation of a limited-capacity resource due to unrestricted entry leads to its total collapse.

- Cheap Pearls

- Commission Rush

- Fished Out!

- Market Entry

- Rivalry and Excludability in Goods

- The Tragedy of the Anticommons

- The Tragedy of the Popsicle Commons

- Tragedy of the Commons

transaction cost

The accessory cost associated with completing a market transaction other than the posted price of the traded item itself. It covers many things including information discovery cost, legal fees, negotiation cost, and even transportation cost. In general, any similar barrier or friction.

- The Dust Bowl - Natural or Man-made Disaster?

- The Sharing Economy

- The Tragedy of the Anticommons

- Tipping the Scales

- Transaction Costs and Market Structure

- Water Disputes in California

two-part pricing

Two-part pricing consists of a lump-sum upfront charge (or a flat cover charge) and per unit price of selected items.

unit elastic demand

Demand is unit elastic when the percentage change in quantity demanded is equal to the percentage change in price. Total revenue would not change with small price changes.

use quota

A right to engage in certain restricted activities which can lead to a collectively bad outcome if done in excess. These rights are assigned to current participants to limit their access to commons goods with limited renewable capacities. For example, fishing quotas and pollution quotas are example of such rights. These quotas are usually transferable so that they end up in the hands of those who can use them most profitably. Because the issued quotas are capped, they are a form of tax that would raise the marginal cost of the targeted activity.

use right

The right to derive value from using the good for self consumption as contrasted to selling it for money. For example, de facto property rights usually cannot be sold for money. In other words, these de facto rights are use rights that have only use value but not exchange value.

use value

Value derived from using the good for self consumption as contrasted to selling it for money. For example, de facto property rights usually cannot be sold for money. In other words, these de facto rights have only use value but not exchange value.

variable cost

Cost that varies with the level of output or action taken. Under short-run diminishing returns, variable cost will eventually increase at an increasing rate even though fixed cost stays the same.

vertical integration

The integration of all phases of production and distribution under one big company.

wage arbitrage

Migration of production from high-wage to low-wage areas to lower labor costs and increase profits by selling the outsourced output back to high-wage areas.

windfall profit

Windfall profit is unexpected market net gain without any effort from the gainer.

yield

The return on an investment. In the case of bonds, the yield that is of interest is the current yield, which measures the fixed coupon payment as a percentage of the current market price of the bond. The current yield varies inversely with the current market price of the bond. The current yield can be contrasted with the coupon rate, which measures the fixed coupon payment as a percentage of the face value of the bond at issue date.

- A Nation of Money Hoarders

- Banks and Non-Bank Finance

- Bonds vs Stocks

- Bubble Economics

- Liquidity Trap

- Savers, Suckers?

- Shaky Union

- The Greek Debt Tragedy

- The Yield Curve

- Under Water

- Who Rates the Raters?

yield curve

The yield curve depicts how yields of Treasury debts vary with their borrowing durations (i.e., maturities).