Deficit and Debt (transcript)

Debt/income ratio will rise as long as the deficit exceeds debt times the income growth rate.

When spending exceeds income, a deficit occurs.

Because deficit must be financed by borrowing, it adds to debt.

And if the debt grows faster than the increase in income, the debt/income ratio would increase forever.

Let's say the income grows at 5% per year and the debt grows at 7% per year, the debt/income ratio would pass 100% eventually.

The debt/income ratio is important because interest must be paid to carry a debt and the interest payment will in turn add to the debt burden if the interest is not paid off from current income.

So how fast can debt grow for the debt to be affordable?

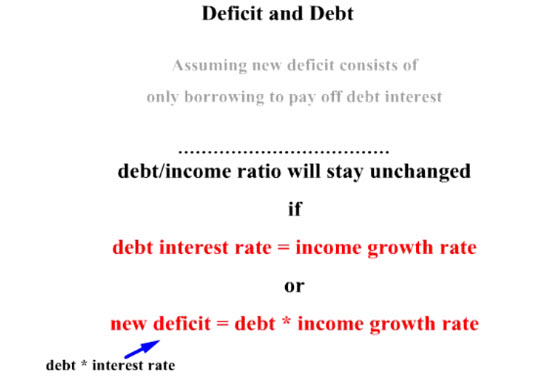

The new borrowing to finance the interest payment cannot exceed the existing debt times the growth rate of income.

In other words, the debt/income ratio will stay unchanged if both debt and income increase at the same rate.

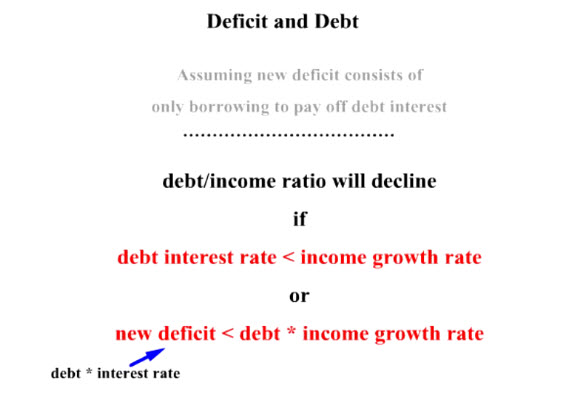

When will the debt/income ratio decline?

The ratio will decline if the new borrowing to finance the interest payment is less than the existing debt times the growth rate of income.

For example, when debt grows at 3% per year and income grows at 5% per year, the debt/income ratio will decline gradually over time.

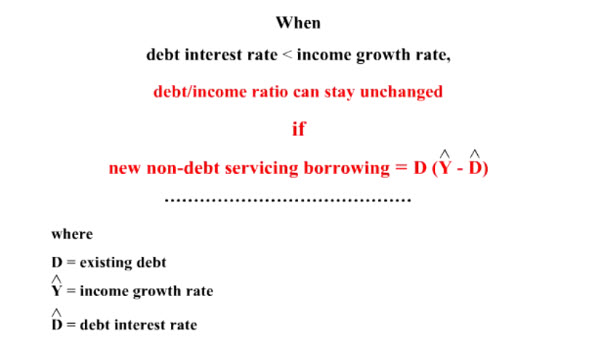

If the growth rate of income is higher than the debt interest rate, new non-debt servicing borrowing can also be supported without increasing the debt/income ratio.

The debt/income ratio can also decline during inflation when nominal income is inflated more than nominal debt. To be really financially solvent, it is therefore important to state the solvency condition in real terms. Real income growth rate ≥ Real interest rate

Summary

• When spending exceeds income, a deficit occurs

• When deficit is financed by borrowing, it adds to debt

• When the interest rate on existing debt is higher than the growth rate of income, the debt/income ratio will go up if the interest payment is financed by new borrowing

• Financial solvency requires that the real income growth rate be at least as high as the real debt interest rate

• An ever increasing debt/income ratio is not sustainable

• In 2008, the public debt/GDP ratio in the US was 61% and 170% in Japan

Glossary:

- Gross domestic product (GDP)Gross domestic product (GDP) measures the total market value of all final goods and services produced in a country in a given year, plus exports, minus imports. "Gross" means that capital depreciation allowances have not been netted out from the total.

Topics:

Keywords

debt, debt interest rate, debt trap, debt/income ratio, deficit financing, income growth rate, solvency condition