Trade Deficits (transcript)

Trade deficits fund budget deficits and excessive consumption.

GDP

In a closed economy, the gross domestic product (GDP) consists of consumption (C),

investment (I) (main, frame 10) and government purchases (G).

NX

In an open economy, some goods and services domestically produced would be exported, and some foreign goods and services would be imported. The gap between exports and imports is called net exports (NX). These net exports (NX) have to be added to C, I, and G to make up the GDP.

Here NX is positive because exports exceed imports.

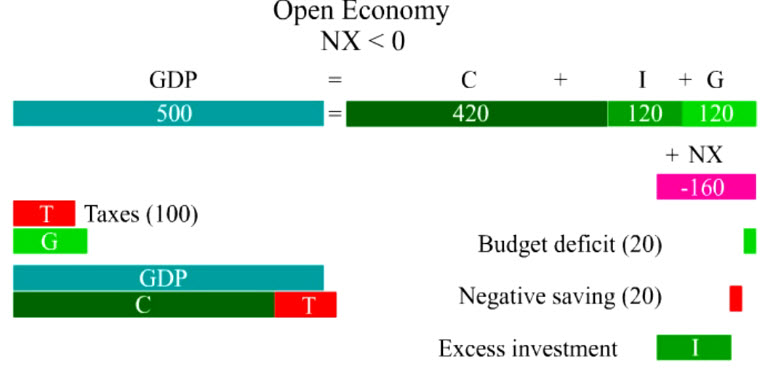

If consumption (C) and government spending (G) are higher, the sum of C, I, and G would exceed GDP.

These excess domestic expenditures would have to be made up by negative net exports. In other words, by importing more than the economy exports.

When negative net exports are subtracted from domestic expenditures, the total would be equal to GDP

To see how negative exports help to fund excess domestic expenditures, let’s introduce taxes (T).

Since taxes are lower than government spending (G), negative exports help to fund the budget deficit.

And since consumption and taxes together exceed GDP (animate frame 175 to 190), negative exports help to fund the negative saving.

And since domestic saving is negative, negative exports help to fund all the investment.

Equation explanation

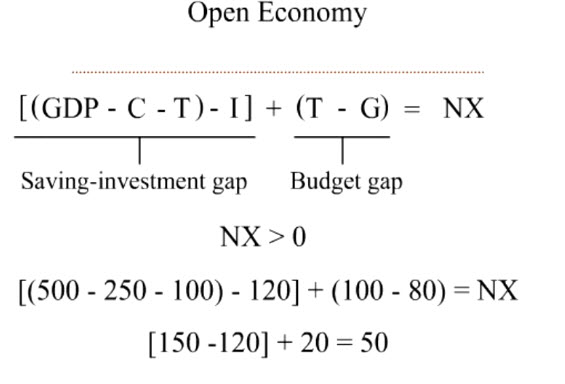

In an open economy, GDP must take into account what has been exported and imported (that is net exports NX) in addition to consumption (C), investment (I) and government spending (G).

To see how net exports (NX) affect the domestic economy, let’s leave NX on one side of the equation.

By introducing taxes (T) into the left-hand side of the equation, we can see that GDP minus C minus T amount to private saving. Subtract investment (I) from private saving, we have that saving-investment gap.

Taxes (T) minus government spending (G) is nothing but the budget gap.

Viewed in this light, net exports (NX) cover the saving-investment gap and the budget gap.

When exports exceed imports, NX is positive. How might this positive NX come about?

Let’s substitute some numbers into the equation. Say GDP is 500.

C is 250.

T is 100.

I is 120.

T is 100 again.

G is 80.

So, it turns out the positive NX is generated by a positive saving-investment gap and a budget surplus.

A different set of numbers may generate only a positive saving-investment gap but a budget deficit. But as long as the sum of the gaps remains positive, NX will be positive.

(long pause until the next case of negative NX).

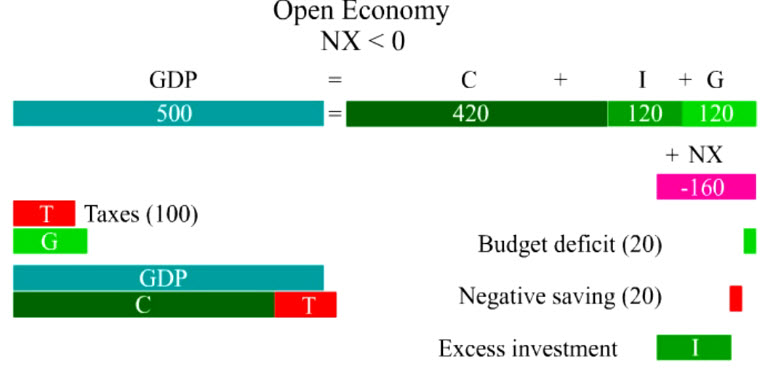

On the other hand, when imports exceed exports, NX is negative (frame 130). How might this negative NX come about?

Let’s substitute some numbers into the equation. Say GDP is still 500.

C goes up to 420.

T stays at 100.

I stays at 120.

T is 100 again.

G goes up to 120.

So, it turns out the negative NX is generated by a negative saving-investment gap as well as a budget deficit.

In the USA, the negative NX is manifested as a chronic trade deficit. This trade deficit has funded the budget deficit as well as excessive consumption.

Glossary:

- Gross domestic product (GDP)Gross domestic product (GDP) measures the total market value of all final goods and services produced in a country in a given year, plus exports, minus imports. "Gross" means that capital depreciation allowances have not been netted out from the total.

Topics:

Keywords

budget deficit, budget gap, budget surplus, GDP, net exports, NX, saving-investment gap, taxes, trade deficit