Crowding-out Effect (transcript)

Budget deficit crowds out investment.

GDP

In a closed economy with no foreign trade, the gross domestic product (GDP) includes consumption (C), investment (I) and government purchases (G).

Saving with taxes

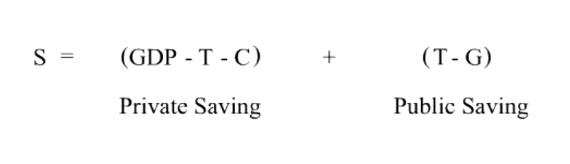

If we subtract consumption (C) and government spending (G) from GDP, what is left is saving (S), which by definition must be equal in value to investment (I).

By introducing taxes (T) into the saving equation, saving can be decomposed into private sector saving and government-sector saving.

Budget surplus

Given a certain level of taxes (T) with the assumed level of government spending (G), there is a budget surplus.

Subtracting this same level of taxes (T) and the assumed level of consumption (C) from the GDP, there is positive private saving.

The sum of budget surplus and positive private saving must then be equal to investment.

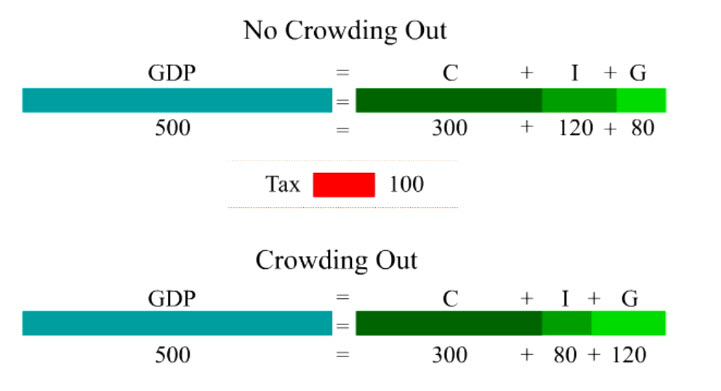

If government spending expands while taxes stay the same, a budget deficit results.

Private saving is not affected by the larger government spending because taxes and consumption stay the same as before.

But total saving is reduced by the amount of budget deficit.

Because net saving has been reduced, investment must be reduced to match the lower saving.

Thus, the government budget deficit in effect has crowded out investment.

Glossary:

- planned vs realizedIn the real world, what is realized may not be what is planned. For example, a married couple does not imply a happily married couple. But the marriage will last only if the couple is happily married. In terms of income determination, a given level of income can be sustained only if planned investment is equal to planned saving because what is not spent on consumption must be plowed back into investment to stop the leakage from the income stream. But in terms of income accounting, realized saving must always be equal to realized investment. For example, capital goods that are not sold end up as unplanned inventory of the producer.