Money multiplier (transcript)

In a fractional reserve banking system, the Central Bank needs to print only a fraction of the total money supply. This fraction depends on the average circulation needs of the banking customers. The rest of the money supply could be created by banks through loans.

Introduction

Modern money is created in exchange for a promise to re-pay. On the Federal level, the Central Bank prints currency notes in exchange for Treasury bonds.

When the currency is deposited in commercial banks, the currency can be used as reserves to greatly expand the money supply through loans.

This then is the so-called money multiplier effect.

Fractional Reserve Banking

If the banking public needs to access on average only 10% of their bank deposits, 90% of the bank deposits would be idle most of the time.

That means $1000 are enough to support $10,000 of demand deposits.

In other words, the demand deposits which can be withdrawn with a check are as good as paper currency.

Therefore, in a fractional reserve banking system, the Central Bank does not have to print $100,000 of currency to create $100,000 of money supply.

Instead, the Central Bank needs to print only a fraction of the total money supply. This fraction depends on the average circulation needs of the banking customers.

Money Creation Process

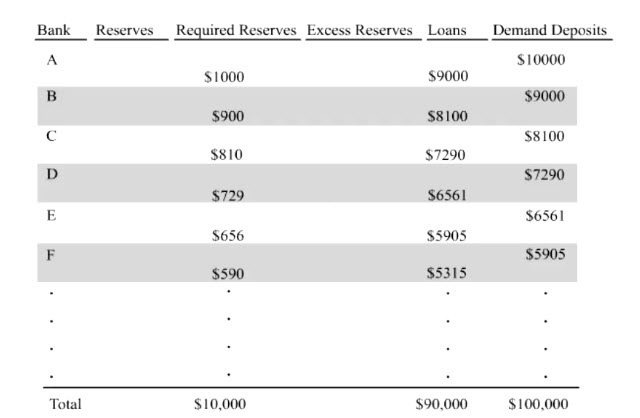

Let's follow the step-by-step process of money creation in the banking sector.

Suppose $10,000 of reserves have been created and deposited into Bank A.

These demand deposits are matched by the same amount of reserves.

But in a fractional-reserve system, we don't need $10,000 reserves to back up $10,000 of demand deposits.

Suppose the required reserves are only 10% of the demand deposits.

The required reserves are only $1000.

The rest ($9000) is excess reserves which could be loaned out to earn interest.

Let's assume that the loan will be spent and the recipient deposits the $9000 into his Bank B account.

Again, only 10% of the reserves needs to be kept at Bank B to back up the new demand deposits of $9000.

The rest ($8100) could be loaned out to earn interest.

Let's assume that the loan will be spent and the recipient deposits the $8100 into his Bank C account.

Again, only 10% of the reserves needs to be kept at Bank C to back up the new demand deposits of $8100.

The rest ($7290) could be loaned out to earn interest.

Let's assume that the loan will be spent and the recipient deposits the $7290 into his Bank D account.

And so on.

After many rounds, a total of $90,000 of demand deposits has been created through loans.

In all, the injection of $10,000 reserves into the banking system results in 10 times the amount of demand deposits.

Money Creation Process – Summary 1

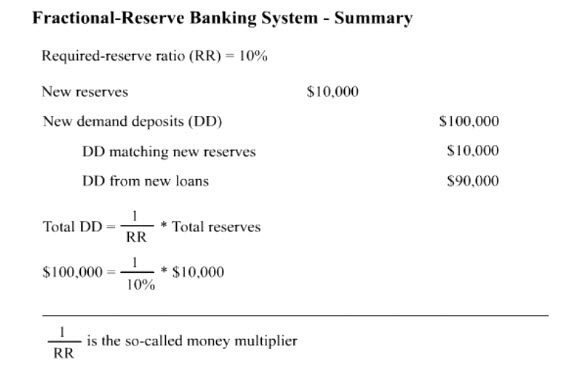

To summarize, in fractional-reserve banking system with 10% required reserves,

$10,000 of new reserves can create 10 times the amount of demand deposits; of which, $10,000 match the newly injected reserves, $90,000 match new loans using excess reserves.

Total demand deposits are therefore the reciprocal of the required-reserve ratio times the injected reserves.

The reciprocal of the required-reserve ratio is the so-called money multiplier.

It is analogous to the income multiplier.

Bigger Context

• Banks created money (DD) by making loans

• Loans are profitable because they earn interest

• Once a bank has used up its excess reserves, it can no longer make new loans

• If the bank can sell its loans to investors through securitization, it can make new loans with the sales proceeds as new reserves

• Because loans can be securitized and sold off, banks tend to be less careful about the soundness of their loans

• The credit crunch starting in 2007 resulted from the collapse of the securitization market due to excessive sub-prime bank loans

• The Federal Reserve has been buying non-conventional bank assets to inject reserves into the banking sector hoping to moderate the credit contraction.

Topics:

Keywords

Central Bank, demand deposits, excess reserves, Federal Reserve, fractional reserves, fractional-reserve banking, loans, money, money multiplier, required reserves, reserves